Ubisoft has released its full-year earnings for fiscal year 2024-25, highlighting a challenging period in which every game released in 2024 underperformed or flopped, but made sure to tout the strong performance of Assassin’s Creed Shadows in addition to the strategic moves enacted to reshape the company’s future with the Tencent deal. Despite a decline in net bookings, Ubisoft delivered positive free cash flow and outlined ambitious plans to optimize its portfolio and organization.

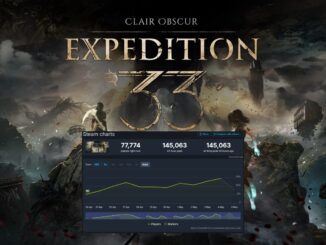

Q4 proved to be a high point for Ubisoft, with record net bookings of €902.3 million, up 3.4% from €872.7 million in Q4 2023-24. The launch of Assassin’s Creed Shadows on March 20 was a standout, achieving the second-highest Day 1 sales revenue in the franchise’s history, trailing only Assassin’s Creed Valhalla. The game set a new record for Ubisoft’s Day 1 performance on the PlayStation digital store and earned a 91/100 average score across first-party stores. Players logged 160 million hours, with consumer spending and player counts outperforming Assassin’s Creed Odyssey.

However, Ubisoft decided not to provide any solid figures such as copies sold or even if the initial 3 million players engaged with Assassin’s Creed Shadows had increased since that milestone was reached during its first month of release. In fact, the company offered no new information that hadn’t already been released prior to the earnings report.

While Q4 bet bookings were up 3.4% over the previous year, Ubisoft went on to report that net bookings of €1.846 billion for FY 2024-25 was down 20.5% from €2.321 billion in FY 2023-24. According to the report, the €475 million loss was due to lower-than-expected partnership revenue. IFRS 15 sales totaled €1.899 billion, a 17.5% decline year-over-year, while non-IFRS operating income was a loss of €15.1 million, compared to a profit of €401.4 million the previous year. IFRS operating loss stood at €82.6 million.

The company generated €128 million in free cash flow driven by €169 million in cash flow from operating activities. Ubisoft maintained a balanced sheet with €990 million in cash and reduced its non-IFRS net debt to €885 million from €985 million, with IFRS net debt at €1.176 billion.

Back-catalog net bookings grew double digits in Q4, driven by titles like Rainbow Six Siege, which saw stable annual performance and a record Battle Pass conversion rate with its Operation Prep Phase update. Ubisoft is expecting that its upcoming Siege X, set for June 10, will expand its player base with the title’s modernized gameplay and free-to-play model. The Crew Motorfest and Avatar: Frontiers of Pandora also posted strong engagement, with double-digit growth in activity metrics.

The company also released figures regarding its player base stating that there were 134 million unique active players and 36 million monthly active users across FY2024-25. The Assassin’s Creed and Rainbow Six franchises each sustained around 30 million unique active players for the fourth consecutive year, while Far Cry held steady at 20 million.

The report also mentioned the company’s recent moves in shaping the company which involved a new subsidiary, announced back in March, being backed by Tencent that will focus on growing Assassin’s Creed, Rainbow Six, and Far Cry franchises. Tencent’s €1.16 billion investment for a 25% stake values the subsidiary at €5 billion, with Ubisoft retaining control and expecting €80 million annually in royalties. The transaction, deemed fair by independent expert Finexsi, is set to close by year-end, fully deleveraging Ubisoft’s balance sheet.

Ubisoft also pointed out that the company, over the past year, has fired 1,230 employees bringing the total headcount to 17,782. The reduction saw Ubisoft Leamington closed down according to a post on the studio’s LinkedIn account.

For FY 2025-26, Ubisoft is projecting stable net bookings, break-even non-IFRS operating income, and negative free cash flow due to transformation costs. Post-Tencent transaction, the company expects a near-zero net debt position. Key releases include Siege X, Anno 117: Pax Romana, Prince of Persia: The Sands of Time remake, Rainbow Six Mobile, and The Division Resurgence. Beyond FY 2025-26, Ubisoft anticipates positive operating income and free cash flow in FY 2026-27, with major content from its top brands in FY 2026-27 and FY 2027-28.

Author’s Note:

Support this site by donating via Paypal or even checking out our merchandise on RedBubble where you can find designs that cater to writers and readers. Money donated and raised goes into paying for this website and equipment.

Interested in posting this article, commissioning a follow-up article or editorial, on your website? Check out our prices to make that happen – https://tinyurl.com/mrxa56pp

[…] [ May 14, 2025 ] Ubisoft Reports FY 2024-25 Earnings: YoY Losses and Assassin’s Creed Shadows … […]